When I started leap years earlier this year, I expected a significant portion of my published essays would revolve around personal finance.

After a few months of writing a microseries titled dumb money, I realized I didn’t quite enjoy the genre. In an attempt to establish my credentials, my finished products often manifested as research papers with more citations and concrete evidence than a Kendrick Lamar diss track (i.e. check out this essay I wrote on credit cards). Overall, they were not super fun to write, and it was only through growing out of my self-imposed niche that I began to find fulfillment in my creative process itself.

With that being said, I can’t help but notice that the new year is just a calendar flip away, and maybe—just maybe—you’re wondering to yourself whether this will be the year you finally take control of your finances.

Despite feeling a pang of disgust recalling my earlier, disingenuous attempts at writing on the subject, I still want to use my built-up personal finance knowledge to help others.

And so I asked myself a really basic question: if my closest friends reached out for advice on getting started with investing, what would I share with them?

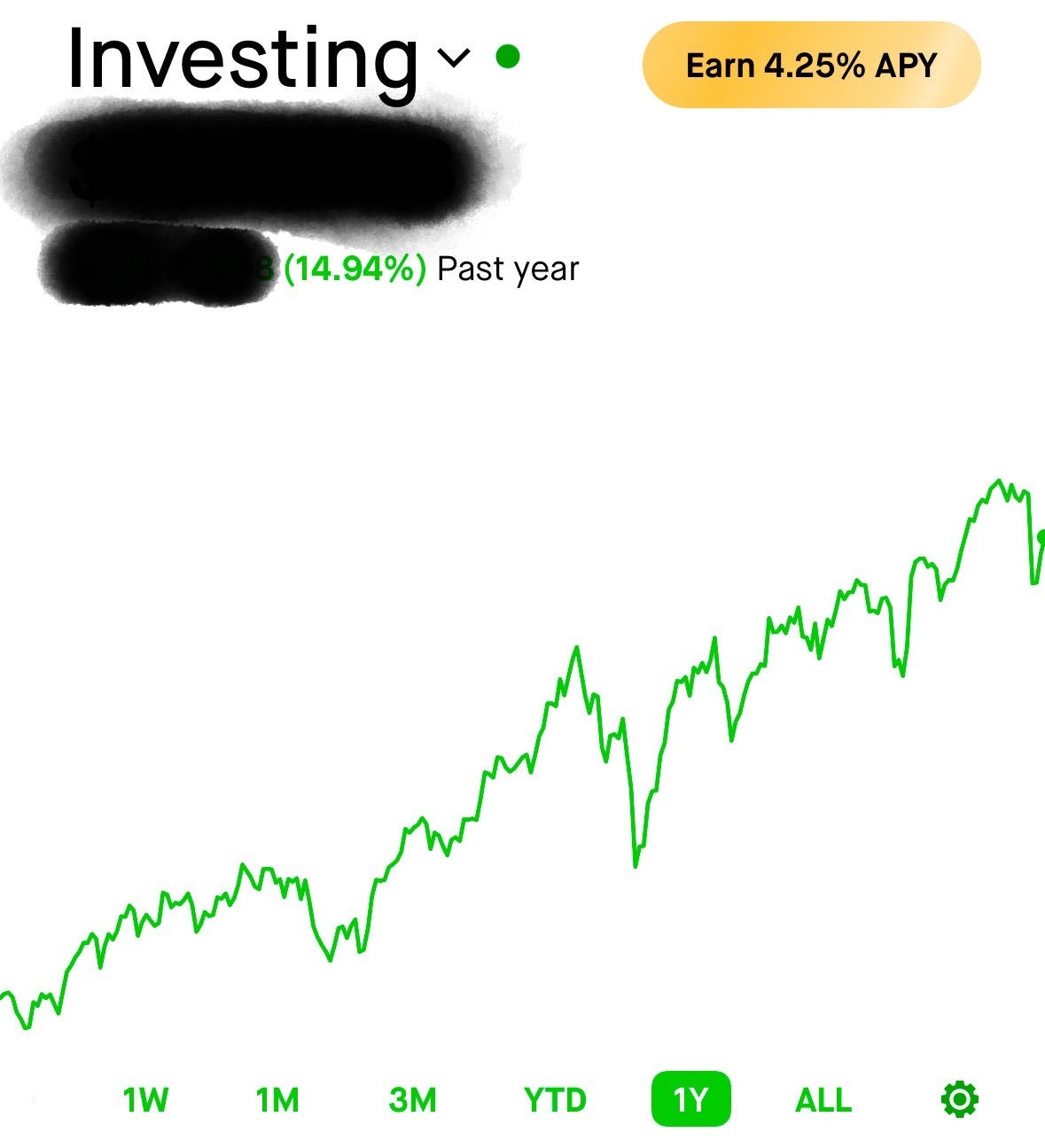

Quite honestly, I would send them screenshots of my recurring Robinhood orders along with a tbh I don’t really know but this works well for me.

And that’s how I’m approaching this essay—rather than writing a research-heavy piece on investment psychology and frameworks, ala dumb money, I decided that it’d be most helpful and interesting if I just shared exactly what I’m investing in these days.

But Raymond, aren’t you worried about revealing such super private information? Well, the reason why I don’t mind sharing all this stuff is because I, quite frankly, don’t do anything sexy with my money! I’m a firm believer that personal finance should be as simple and require as little brain power as possible.

There are much more challenging resolutions out there that require genuine soul-searching and effort, like improving your relationships with loved ones, cleaning up your mental health, working toward a promotion, or finally taking initiative on the business idea you’ve had for years.

So let’s get this money stuff sorted out.

To get some formalities out of the way, I’m a 23-year-old working a steady full-time corporate job. I believe my investment strategy sets me well on track to achieve my financial goals, which are as follows:

Take advantage of all the freebies I can. These include tax advantages, employer matches, high interest rates, and the law of compounding.

Save adequately for retirement so I can hang up the boots around age 60. This means finding a balance between oversaving (living with a scarcity mindset) and undersaving (being stupid).

Build and maintain an emergency fund in a high-yield savings account.

Set aside some money to play around with individual stocks and crypto.

Practice a set it and forget it strategy.

For those starting off fresh (a.k.a. me a year-and-a-half ago) here is the order in which I would tackle savings and investment. They will require some upfront effort and studying on your end, but once you have things set up, recurring investments and compounding will take you the rest of the way there.

401k: Max out your 401k with your employer in order to get a full company match; preferably a Roth 401k, since it offers up better tax advantages than the traditional 401k. However, if the Roth’s additional tax prevents you from investing enough to get your full match, then it’s worth it to go for the traditional 401k.

HYSA: Save up your emergency fund into a high-yield savings account (HYSA). Make sure to open up an account with a credible institution that is FDIC-insured, and don’t obsess over rates. In the long run, no one HYSA is better than the other. Best practices say to save 3-6 months of living expenses. I use Apple’s HYSA and have 6 months worth of rent saved into it.

Roth IRA: Open up a Roth IRA and set up recurring investments into it. The Roth IRA is another tax-advantaged retirement savings account; we can put up to $7k into it per year. You don’t even need to be employed to open one, so if you’re still in grad school or are working part time, the Roth IRA is extra important for you! I use Robinhood’s Roth IRA.1

Individual Stocks & Crypto: As a young adult, your leftover savings should go into stocks (and if you’re up for it, some crypto), rather than into your HYSA or bonds. Unless you are saving for something immediate, it’s mathematically worth it to lean into the power of time and compounding as early as possible.

I dollar cost average (DCA) monthly into my individual stocks and crypto, which guarantees that I don’t overpay for my assets. Here is how my recurring stock investments are broken down:

40% into Vanguard Total US stock

27% into Vanguard S&P 500

20% into Berkshire Hathaway

13% into Vanguard Total International stock

This is essentially a higher-risk variant of the famous three-fund portfolio, because it swaps out the global bond market fund for the S&P 500. Honestly, the 20% I put into Berkshire Hathaway raises even my own eyebrow. If anything, the fact that this recurring investment continues to live on in my portfolio is a testament to how sticky and effective automatic processes are. It would require too much effort to edit and/or cancel the order, and so it persists.2

There was a time when I was more into cryptocurrencies; while I’ve since fallen a bit out of interest with the coins themselves, I remain bullish on the potential of blockchains and Web3. In my Coinbase, I dollar cost average into Bitcoin, Ethereum, and Solana. Alongside believing in the tech, I don’t think I can afford to be a non-player when it comes to participating in the most profitable asset class of this decade (FOMO alert). At the same time, I only invest ~1% of my income in crypto (ah, this dude’s hella calm and composed).

My understanding is that Bitcoin moves with the general sentiment of crypto, Ethereum has been the forerunner to becoming the main all-purpose network of Web3 (i.e. they’re trying to become the Google of the new internet age), and Solana is an important player because it’s provides incredible speed allows real-time applications to be built on top of it.

And that’s a wrap! Hope you enjoyed being nosy and learning about all my investments. Let me know how my investing practice and ideology deviates from yours—I’m always open to new ideas and revamping my strategy.

Full transparency, I don’t max out my Roth IRA because I feel comfortable with the amount of money going into my employer 401k at the moment, and as you’ll see in step 4, I wanted to set aside some money for personal investments. But for most, I’d recommend maxing out the Roth IRA—for those worried about early withdrawals, you are allowed to withdraw your principal from Roth IRAs (i.e. the amount you invested) anytime without penalty.

I created the recurring investment over a year ago, solely based on the fact that Berkshire has beat the market for quite some time. But past performance cannot be indicative of future gains, so in due time I should look into diversifying my Berkshire stock into the other three Vanguard assets.

i think DCA + your funds are very sexy

also just realized one of your "recommend Substack" lines is "brought to you by a 23 y/o finance bro." hahhah love it!