Hi friends! Welcome back to dumb money!

The driving principle behind this series is simplicity. I believe that as long as we direct our efforts toward developing high-value habits, it’s possible to win the money game with minimal time and effort.

Over these last few years, I’ve read my fair share of personal finance books. Some of them were good, some were bad, and some genuinely lowered my IQ. In this week’s post, I’m excited to share with you the crème de la crème.

The three best personal finance books I’ve selected all share the following qualities:

They are easy to read.

They will help you worry less about money.

They are optimistic and realistic.

They do not invoke FOMO as a decision-making tool.

They acknowledge the psychology behind managing your finances AND help you address them head-on.

Simply put, these books cut through all the noise. I believe that pretty much all of my healthy financial habits were either introduced to me or confirmed by these books.

Without further ado, let’s jump into our big three.

1) The Psychology of Money by Morgan Housel

This book feels like a nice brain massage. Housel identifies the common psychological pitfalls we face when it comes to money, breaks down why we have been conditioned to think in such a way, and reframes our thinking to be more practical and optimistic.

The Psychology of Money isn’t just a personal finance book. Its a meditation on the universal challenges of wealth, greed, and happiness across all socioeconomic classes.

Here are a few of my favorite quotes from The Psychology of Money:

On sticking with long term habits: “Do not aim to be coldly rational when making financial decisions. Aim to just be pretty reasonable. Reasonable is more realistic and you have a better chance at sticking with it for the long run, which is what matters most when managing money.”

On the value of money: “Money’s greatest intrinsic value—and this can’t be overstated—is its ability to give you control over your time. To obtain, bit by bit, a level of independence and autonomy that comes from unspent assets that give you greater control over what you can do and when you can do it… doing something you love on a schedule you can’t control can feel the same as doing something you hate.”

On the danger of studying individual success and failure stories: “The more extreme the outcome, the less likely you can apply its lesson to your own life, because the more likely the outcome was influenced by extreme ends of luck or risk.”

On compounding: “But good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It's about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That’s when compounding runs wild.”

enjoying this piece so far? if you haven’t already, click the button below to make sure that you receive my next piece in your inbox. and if you want to read more of my posts, check them out here!

2) I Will Teach You To Be Rich by Ramit Sethi

I know, this one sounds a bit scammy. Trust me: its anything but.

The book itself is structured as a 6-week “improve your financial hygiene” program. Each chapter ends with actions items and the estimated time it would take to complete them. In a little over 300 pages, Sethi covers pretty much every personal finance topic out there:

Credit Cards

Bank Accounts

Retirement

Conscious Spending

Automation

Investing

Building a Rich Life

Sethi is hilarious and surgical with his explanations. Ultimately, what you’re paying for here is a one-stop study guide that cuts through all the online B.S. I Will Teach You To Be Rich is filled with validated, objective, and expert advice you can trust.

3) The Almanack of Naval Ravikant by Eric Jorgenson

This book is completely free, which should already be a green flag.

The Almanack is a compilation of Naval Ravikant’s most relevant writings and talks on wealth and happiness. If you don’t know who Naval is, that’s fine, I didn’t either until I read the book. I still got a lot out of it.

This book is a bit more big picture. The focus isn’t on building specific personal finance habits, but rather on how to identify and leverage the unique skills you have to build a wealthy and happy life that works for you.

Here are a few of my favorite quotes and diagrams from The Almanack of Naval Ravikant:

"Become the best in the world at what you do. Keep redefining what you do until this is true."

"Earn with your mind, not your time."

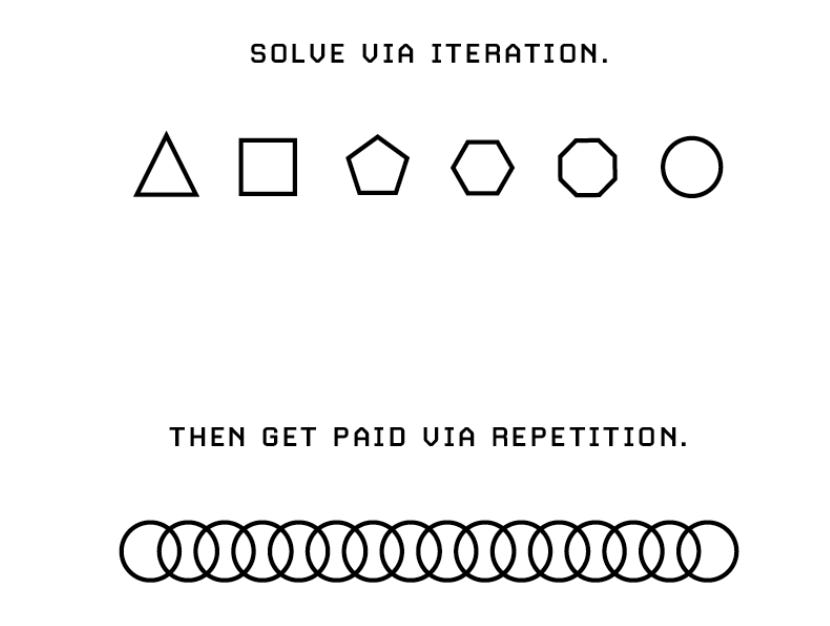

“Solve via iteration. Then get paid via repetition.”

"Tension is who you think you should be. Relaxation is who you are."

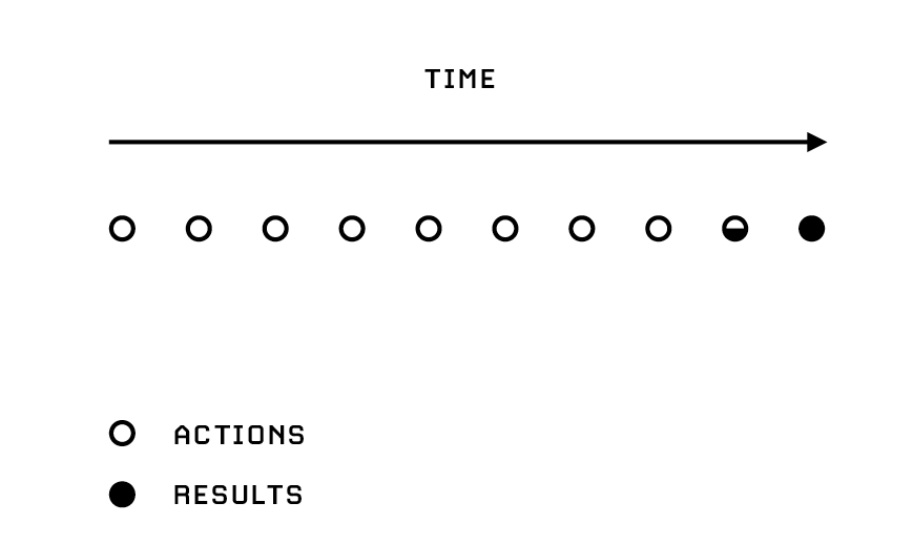

"Impatience with actions, patience with results."

"Inspiration is perishable, act on it immediately."

I hope you find these books valuable.

At the end of the day, it's up to you to read and implement these philosophies. Reading is the easy part. Taking action is tougher.

One suggestion I have for you is to actively reflect as you read. Take a minute or two after finishing each chapter to write down how you can apply what you just read to your life. I’m going to be re-reading the Almanack of Naval Ravikant in the coming weeks and will be doing the same thing (in case you need some sort of accountability partner).

Whether you choose to acknowledge it or not, most life decisions are directly tied to earning, spending, or saving money. Having your own philosophy on how to manage your finances is powerful because it gives you the confidence to be intentional with these decisions. These three books have served as a wonderful mentors for me as I continue to develop my own personal finance principles. I hope they can provide you with value too.

Remember, the best investment in our 20s is in ourselves. Building new skills, traveling to places you haven’t been, focusing on your career, meeting new people; these should be our priority. Let’s do the necessary work to build up our personal finance intuition so we can keep investing our time into other, more important areas of our life.

Thanks for tuning into this week’s episode of dumb money!

Intresting read, thanks for writing! I'll be sure to grab some of these for myself. The Psychology of Money sounds like a good book for me as I've always enjoyed more habit based books, I'm just about to finnish Atomic Habits by James Clear actually, and I can see some similarities. I Will Teach You To Be Rich sounds a bit more straight to the point but that's what you need sometimes, gonna check them out soon!

Really well written and a great collection of books!